Current Singapore Economy at a glance

- Annualised GDP down 16.4% last quarter

- According to BNP Paribas: "Collapse in exports and industrial production, weight will fall on Singapore dollar... expect it to weaken."

- SGD has fallen against USD. USD1 : SGD1.60 by June 2009

- According to MOF - growth may "bottom out in the later part of 2009

HONG KONG: - Refund taxes

- Suspend property rates

- Boost spending on infrastructure

SINGAPORE:

- Worker retention plan through credit schemes

A Dose of Mediocre Governance

The foresight and ability of our leaders have proven legendary over the last 40 odd years since independence, MM Lee has reminded us time and again, how it was his (& team- though mentioned sparingly) talents that brought us from third world to first. Dubbed "talent", the salary scale of the ruling elite tabled in parliament and voted overwhelmingly on a massive salary increase to $1.2 million (over $3 million for the PM). Our highly paid leaders have pursued:

Unsustainable Growth Policies

FOREIGN TALENTS! We need them! Cheap labor to support the construction industry!

More inputs = More Outputs.

- 750,000 of 4.1 million populations are foreigners

- Three-Quarters are LOW SKILLED workers

- ONE-quarter are professionals on visit passes

IF ONLY our Foreign Talent policy meant chasing the truely talented ONE-quarter foreigner Entrepreneur-Engineers or Indian Programmer Wunderkinds for our own local silicon valley- these are the real talents that would generate many MANY jobs for Singaporeans.

But our labor policy brings in the runt of the litter for low paying jobs to compete with other equally under-educated Singaporeans.

Not to mention, rather than spend their money here, the artificially inflated population remitted the majority of their money OVERSEAS where it benefitted THEIR HOME COUNTRIES. And after the getting was good, they're leaving. According to Credit Suisse:200,000 of them are leaving.

Oops.

"Pay top dollar for talent," we were told.

In his budget speech to Parliament, Finance Minister Tharman Shanmugaratnam had this to say, "... like other governments and the vast majority of private forecasters, we did not anticipate the speed and scale of the deterioration in the global economy in the last six months".

This is my contention- We were told that we had leaders unlike those of other governments. Our PAP government was the creme de la creme. When pressed, MM Lee insisted that without them, our wives would become maids in other countries and that the economy would flounder and die (have a sense of proportion!). We spent 30 years listening to how the world would do us in and how MM Lee and his PAP team was all that stood between us and the hostile world- HANNIBAL AD PORTAS!

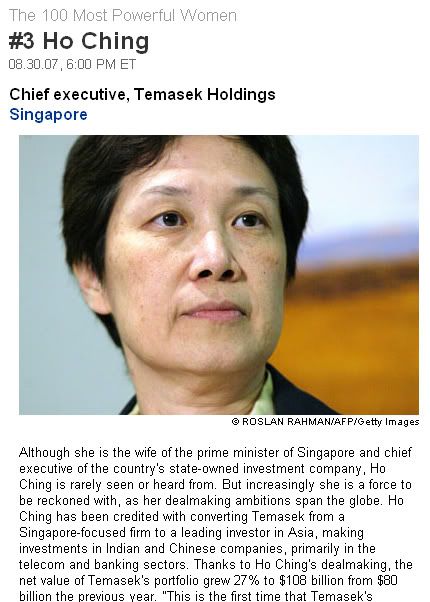

It looks like PAP dropped the ball. With complete trust (of at least 66% of the Singaporeans that did get to vote), we watched awe struck as the meritocratic system placed key talent (which coincidentally were close relations to Singapore's First family) in key positions. Mdm Ho Ching, took her place as Singapore's Chief Financial Officer. With her background in Electrical engineering, she turned investment basics on the head with great cunning. While many advised- When it comes to investing, not all eggs in one basket. Mdm Ho Ching ignored and proceeded on a buying spree into foreign banks- under her, Temasek's investments were expanded to 40% of the portfolio by 2008.

The financial sector collapsed and with it, our eggs.

In one basket.

Gone. 31% lost on its SGD185bn portfolio.

Like salve on wound, MM Lee reminded us- "Long term investing 10, 15, 20 years"

I would agree except that unlike other economic crisis or the dotcom bust, those downturns DID NOT trigger a crash in the financial sector- Recovery is only natural because in those previous crisis- the system worked!

As international trade continues to contract, possibly into deep negatives, the very heart of the global economy has gone into cardiac arrest. Our investment time line would have to be significantly increased. Why?

- With faith sorely shaken in the system- consumerist habits (Developing Asia was feeding Over-consuming US with under valued products) will never be the same again.

- With faith sorely misplaced- the financial juggernauts whom we worshipped and aspired to work for, will no longer find the same value in our urban hearts.

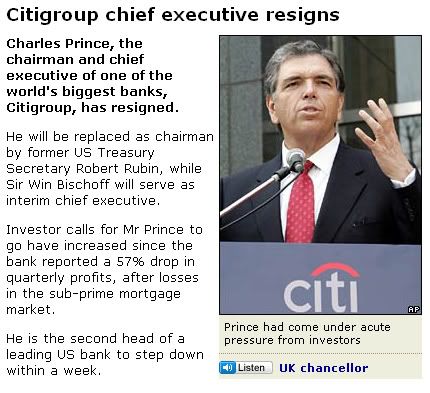

Banks like Citibank have come so close to being nationalised that these "long-term" investments are made eternal and never seen again. I had postulated before that perhaps our PAP government deemed it fit to rescue foreign banks because we depended on these banks keeping credit lines open to the businesses that needed them.

Why did we choose not to shore up OUR OWN local businesses instead?

Why have a "budget" to save jobs that is not really a job saving scheme?

PAP's recession fighting budget

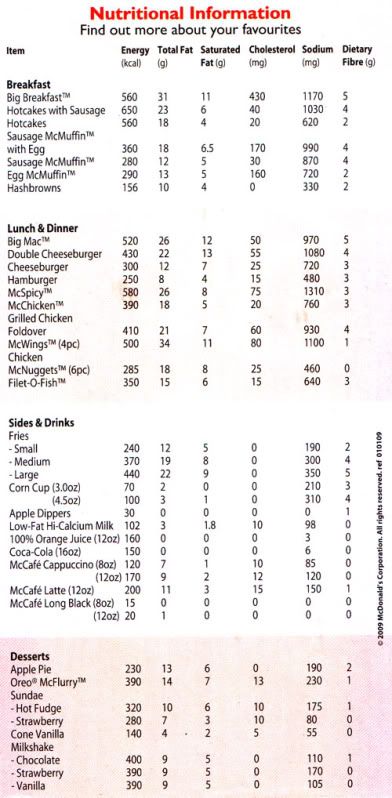

Save jobs with Jobs Credit Scheme: According to The Straits Times- "Under this scheme, the Government pays 12 per cent of the first $2,500 of the wages of all Singaporean workers, including permanent residents.The objective is to encourage employers to retain these workers despite the economic slowdown. The government grants are paid directly into the CPF accounts of workers."

- However, how would a budget that involves putting money from the government's left hand to its right hand (CPF) save jobs?

- More importantly save $300 versus $2500. IF you were an employer, which would you pick?

- Most importantly, weren't we paying our leaders $1.2million precisely on the justification that their talents bought us ideas that worked? Even at a time where the Obama administration is capping salaries at USD500k?

We can't pump prime the local consumer economy

It's true. According to Wall Street Journal, local spending accounts for 40% of Singapore's GDP. Far less than the average 55%.

But could we not pump prime the local BUSINESS ECONOMY?

I'm no economist, but I would imagine a scenario where- money spent on the jobs credit scheme could be tiered in 2 ways.

- Company Cost Savings: As per the original objective if they need to retain the employee because there is still a need for him.

- Entrepreneur Credit: IF said employee was retrenched, a calculated sum of money could be given to him as CASH for day-to-day survival OR retooled as a credit incentive to start his own business. Each dollar converts into $3 credit to open up an aspiring business contingent on the basis that his business needs are met by OTHER start ups.

Example: Phase 1- Tan Ah Teck wishes to set up an internet commerce business called AFFLUX (Affordable Luxuries). He needs a web designer and programmer, the entrepreneur credit can only be spent on services of a local web design and programming company. He'd need mass produced cheap goods obviously- stocks are being cleared in China. Where goods and services cannot be obtained from a local company, his credit is allowed to pay for them overseas.

That way- MONEY IS USED TO STRENGTHEN LOCAL INFRASTRUCTURE- other SMEs and start ups.

Phase 2- Mr. Tan would need to get the word out (Marketing/ADvertising/Public Relations). We're paying $110 TV license fee for "national education". The government can fund local media (since it's nation building anyway and we need to be working, we can enjoy the propaganda when we're well again) and direct them to provide editorial support on FLEDGING start ups. An amount of space is dedicated daily- to the new start ups of the day (similar to American JOBS WANTED ads during the Great Depression but in reverse).

IN ESSENCE, nuture a media eco-system where SMEs are given an advantage to survive. Our EDB advisors scan the economic landscape for gaps in supply, calling for entreprenuers will skill sets to fill the void.

Phase 3- Suspend the paid up capital requirements for seed money from SPRING. Here's why-Apparently, we're paying our civil servants top dollar for their talents and ability to guide the nation through rough waters. And if such, I would imagine, this top dollar pays for talent that can COMFORTABLY analyse a business proposal and chart avenues of growth potential.

Retrenched financial analysts and bank executives will be seconded into the civil service- their goal: to sniff out and smell viable business ideas. On their recommendations, funding will be made available to these start-ups.

These become REAL long term investments- you're betting on a local company's future. You're investing in the LOCAL ECONOMY. Not some distant bank or MNC, the added bonus is that money will circulate in Singapore with spill over that will benefit regional trading partners as benefit from cheaper imports.

Here's some food for thought on Out-of-the-box thinking: TEMPORARILY REDUCE TAXES and DO AWAY with GST.

Yes, taxes keep the public service infrastructure fueled to keep systems running BUT the whole point of reserves is to ensure we have the liquidity to keep wheels turning. I'm just spit balling here but you need people to BUY goods and services.

Look at it this way- we'd still pay our income tax. The government still gets our CPF money to hold but at least, we won't be taxed on spending (since we really want people to spend at this point) on good & services (business or personal) and:

- It'll invigorate the business economy

- Provide a sense of rejuvenation as business starts to breathe new life

- Finally, stimulate demand for goods as a sense of well being returns to stimulate spending

Our Per Capita GDP is USD 48,900. Making us ranked 8th in the world. Ahead of the United States even (www.indexmundi.com).

Time to really decouple from Western economies, once local businesses are up and running, we look to China for what we need. Get THEIR factories going and stimulate THEIR spending as their folks get to earn a wage again.

Defense spending

Increasing Defense spending by 6%. That's $11.45 billion spent.

IT'S THE ECONOMY STUPID.

Countries DO NOT go to war during a recession. They have money to be spent on better things. Yes, World War 2 began 10 years after the Great Depression- that's because the Treaty of Versailles gave a fascist Hitler a tool to unite the country under his madness.

The only way war is likely is if regional neighbours started to look for other countries to blame. And truth of the matter is, as a result of our natural dependence on global trade- the hardest hit economy in Asia is SINGAPORE. We're more likely to look for a fight than our neighbours truth be told.

There's little need for such overtly aggressive spending when everyone else is cutting back. In addition, unless this expenditure is going to benefit local manufacturers with our "burgeoning" defense industry, I really doubt spending 11.45 billion makes ANY fiscal sense.

Not to mention, psychologically, our "deterent" with the increase in military spending is more likely to annoy/provoke our neighbours.

As past depressions have shown- in times like these, countries are more likely to engage in collective action to save the global economy.

Just FYI, Wars are fought over:

- Ideology (Kiasuism doesn't count)

- Gold ( Neither do Rolexes from Ah Bengs)

- Oil (Forget about this one)

- Water (We outsource from Malaysia, invade them)

- Land (Hahahaha. We're "nose snot")

In closing

I'd rather the government was investing in local SMEs, specifically concentrating on Green Industries. The rationale being:

- Capital inflows as our SMEs grow into MNCs that expand overseas.

- SMEs employ over 62% of work force.

- Accounting for over 47% (over $57.5 billion) of manufacturing and services sectors

- The oil scare has proven we need to depend on new energy sources and sustainable growth with renewable and recyclable resources.

I firmly believe the age of the mighty western MNC is at an ebb. Time to watch Asian corporations rise to fill the gap, why should they not be Singaporean corporations ones?